Incentives

Generous Incentives Are Available

Platteville Area Industrial Development Corporation and the City of Platteville avidly support economic development of the region, as does the entire State of Wisconsin. There are numerous state and local incentive programs available to qualifying businesses. Some of these programs include local land incentives, zoning and tax credits, and county and local revolving loan funds.

Click on the tabs below to see the incentives at the city, county, state, and federal levels.

Land Price Formula for Industry Park Lots – Platteville Area Industrial Development Corporation (PAIDC)

The price of industrial park real estate will vary between $1/acre and $67,500/acre based upon the following land price formula. The incentives given will then be based on the business’s intended land improvements (i.e. putting up the building), and credit begins to accrue when project costs exceed the threshold of $250,000 minimum investment, following with $4,000 of incentive for each $10,000 cost of improvements to the land. This investment is expected within 24 months of the date of closing.

*Base land price = $67,500/acre.

**A discount of 10% off of the base land price is for qualified graduates of the Platteville Business Incubator

Incentives are also added in for the number and types of jobs to be generated in a 24 month period:

- Less $1000 for each Level 1 job (($10-$15/hr. including cost of benefits) created within 24 months of the date of closing

- Less $2000 for each Level 2 job ($15-$20/hr. including cost of benefits) created within 24 months of the date of closing

- Less $3000 for each Level 3 job ($20-$30 hr. including cost of benefits) created within 24 months of the date of closing

- Less $4000 for each level 4 job ($30+/hr. or more including the cost of benefits) created within 24 months of the date of closing

The final land price shall be based on the above criteria, and in no event shall the final land price be below $1/acre. The Platteville Industrial Development Corp. will be responsible for determining whether a job, that is created, is to be classified as Level 1, 2, 3 or 4 based upon information to be provided by the buyer.

View an interactive spreadsheet to help figure out Land Price Formulas.

Possible City Incentives

TIF: The Platteville Industrial Park is located in a TIF district and some expenses related to site preparation and infrastructure may be eligible for TIF financial support. All TIF decisions are ultimately approved by the Platteville City Council and must be in compliance with State of Wisconsin TIF regulations.

Based on the type of development dependent on the assessed value (about 60%) of the proposed development, the city may be able to offer a “pay-as-you-go” incentive. This incentive could increase or decrease dependent on the final building tax assessment.

County Revolving Loan Fund – Grant County Economic Development (GCEDC)

The Grant County WI Revolving Loan Fund (RLF) is intended to assist businesses planning to locate in the county as well as existing businesses who are planning expansions. The Revolving Loan Fund program offers low interest loans (3-5%) for equipment purchases, land acquisition, existing building purchases, and working capital, with term limits up to 10 years. The RLF program leverages funds based on full-time job creation by the business within 2 years of the expansion or relocation, up to $10,000 per full-time position created. Grant County’s RLF requires that the business create at least 3 full-time positions in order to apply to the program. Full-time equivalent positions (2 part-time equals one full-time) are not eligible for leveraging of funds.

Contact:

Ron Brisbois, Director GCEDC

office phone: (608) 822-3501

cell: (608) 732-9457

email: gcedc@grantcounty.org

Business Tax Credits – Wisconsin Economic Development Corporation (WEDC)

The Business Development Tax Credit (BTC) Program supports job creation, capital investment, training and the location or retention of corporate headquarters by providing companies with refundable tax credits that can help to reduce their Wisconsin state income tax liability or provide a refund. A business located in, or relocating to, Wisconsin may be eligible for Business Development Tax Credits if the business’s net employment in the state increases each year for which the business claims tax credits. Tax credits are subject to retention requirements; the full program guidelines are available at InWisconsin.com.

Evaluation of all BTC applications will include, but is not limited to, the following factors:

- Whether the project might not occur without the allocation of tax credits

- The extent to which the project will increase employment in this state

- The extent to which the project will contribute to the economic growth of this state

- The extent to which the project will increase geographic diversity of available tax credits throughout this state

- The financial soundness of the business

- Any previous financial assistance that the business received from the Department of Commerce or the Wisconsin Economic Development Corporation (WEDC)

Contact:

Mark Tallman, Regional Economic Development Director, WEDC

cell: (608) 210-6852

email: mark.tallman@wedc.org

Website: InWisconsin.com

For a complete list of incentives available from the state, click here or check out the descriptions here

New Market Tax Credits

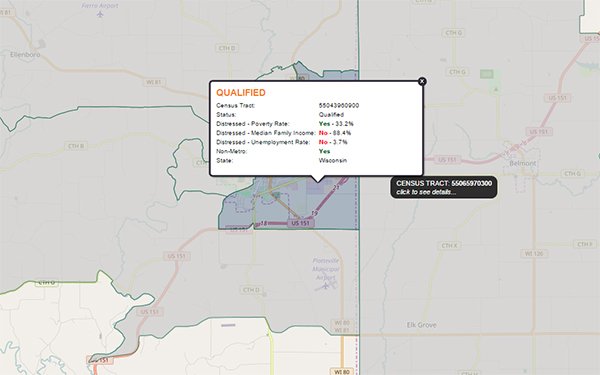

Platteville is one of the few places in Southwest Wisconsin that is eligible for New Market Tax Credits. The federal New Markets Tax Credit (NMTC) program serves as a resource to help fuel job creation and economic development efforts by promoting equity investment in low-income urban and rural communities. WHEDA awards NMTCs to enhance financing for projects in highly distressed areas throughout Wisconsin that have demonstrable community impact. Businesses involved in NMTC deals can obtain benefits including lower interest rates on loans, interest-only payments for seven years, non-traditional financing not available in the marketplace, access to a reduced cost of capital, and more. NMTC recipients include manufacturers, small technology firms, inner-city shopping centers, commercial real estate developments, retail stores, hotels, and health care facilities. Projects must be located in highly distressed census tracts – which are determined by factors such as poverty rates, unemployment rates and the percentage of median family income. The NMTC is a competitive program administered by the U.S. Department of the Treasury’s Community Development Financial Institutions Fund.

Following is a map that illustrates that Platteville’s Industrial area is located in a distressed census tract and qualifies for NMTCs. For more information on your desired address in Platteville, click below to visit Cohn Reznick’s interactive NMTC map.

Platteville is also an SBA Hub Zone. Click here for more information.

The Historically Underutilized Business Zones (HUBZone) program was enacted into law as part of the Small Business Reauthorization Act of 1997 to encourage economic development in historically underutilized business zones. SBA's HUBZone program is in line with the efforts of both the Administration and Congress to promote economic development and employment growth in distressed areas by providing access to more federal contracting opportunities. SBA does the following:

- Determines which businesses are eligible to receive HUBZone contracts

- Maintains a listing of qualified HUBZone small businesses that federal agencies can use to locate vendors

- Adjudicates protests of eligibility to receive HUBZone contracts

- Reports to the Congress on the program's impact on employment and investment in HUBZone areas

Corporate Tax

Businesses are subject to a flat rate of 7.9% tax on income. A number of competitive tax incentives are available to businesses.

Regional Sales and Use Tax

The Wisconsin statewide sales tax rate is 5%. All counties in the region assess an additional 0.5% county tax rate for a total sales tax of 5.5%, below the national median of 5.95%.

Unemployment Insurance Tax

Wisconsin employers pay unemployment insurance taxes on each employee’s wages up to the taxable wage base of $14,000. For more information about unemployment insurance, visit Wisconsin Department of Workforce Development.

Property Tax

Property tax rates vary between individual communities; specific information is available through the Wisconsin Department of Revenue.

Individual Income Tax

Wisconsin individual income tax rates vary from 4% to 7.65%, depending upon marital status and income. A table of individual income tax rates can be found on the Wisconsin Department of Revenue website.